Experts say climate change is fueling extreme weather events, leaving homeowners across the country to face high insurance costs, or in some cases losing full coverage.

Climate change disasters are becoming more frequent and destructive, and the ability to insure a home is a growing concern for homeowners nationwide.

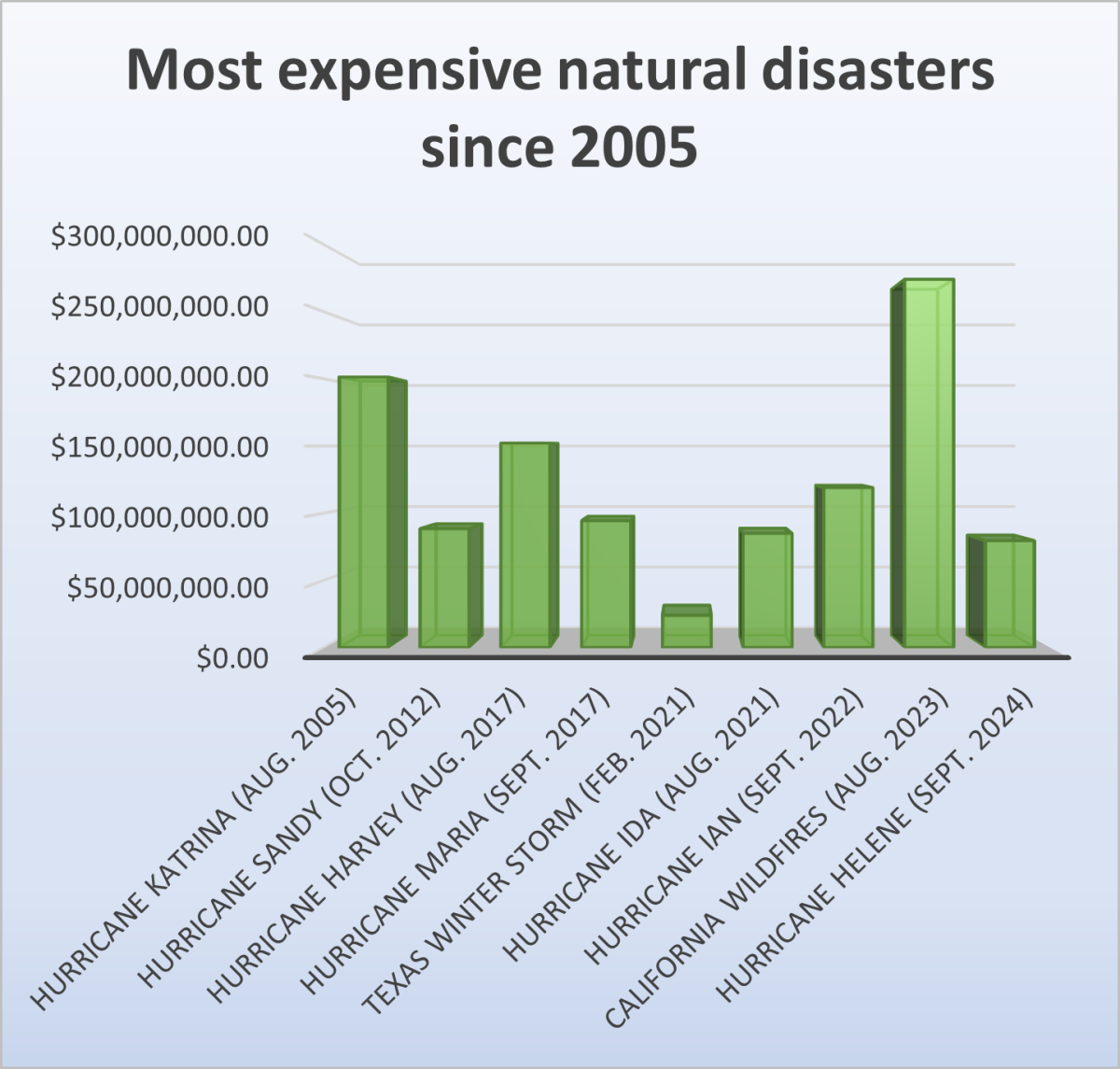

According to the National Oceanic and Atmospheric Administration, in 2024 there were 27 confirmed weather/climate disaster events with losses exceeding $1 billion in the United States.

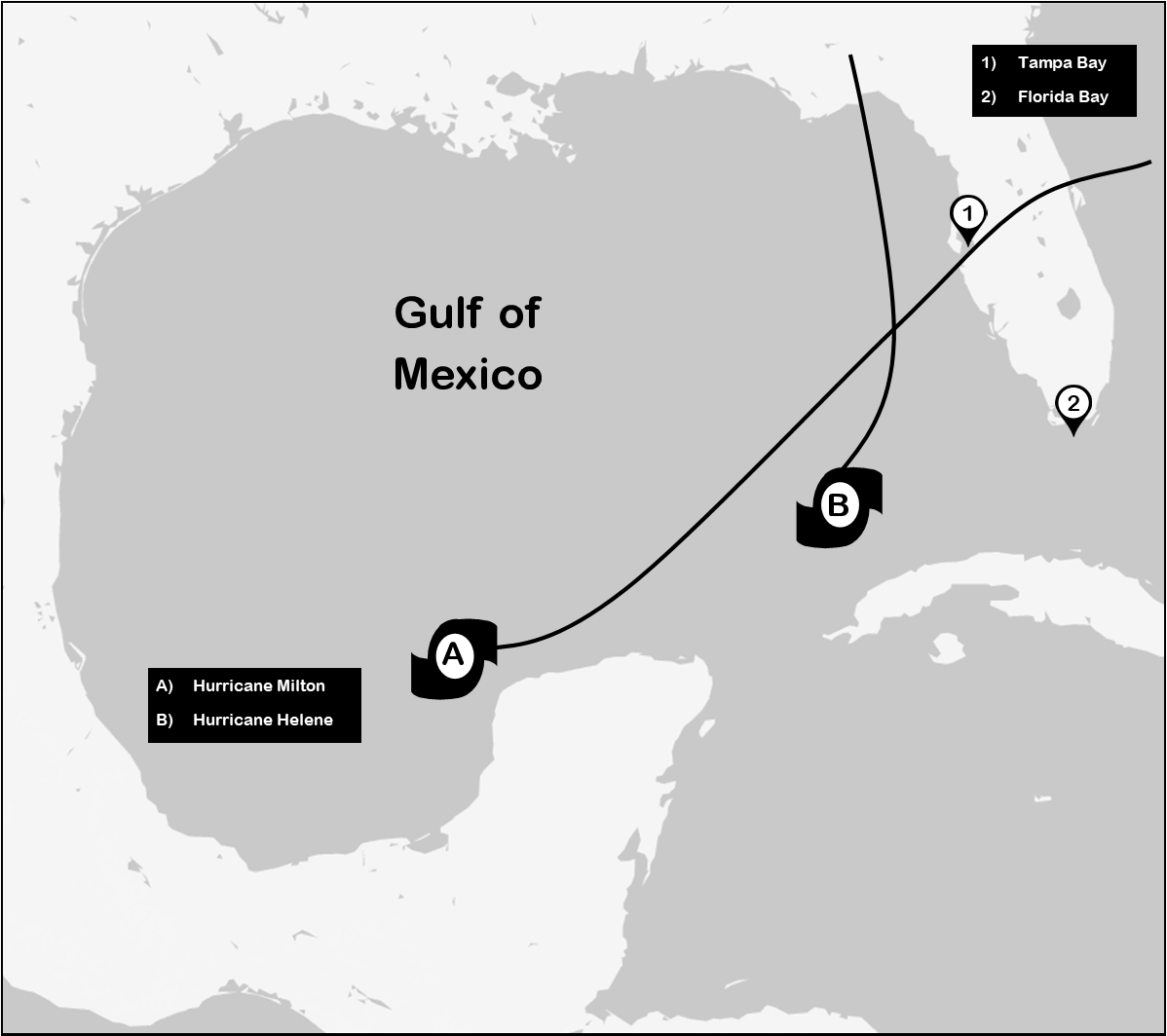

These events included a drought event, a flooding event, a wildfire event, two winter storm events, five tropical cyclone events, and 17 severe storm events.

To add on, those climate disasters led to roughly a 10% to 12% increase in homeowners’ insurance costs in the United States, according to Mark Friedlander, spokesperson for a nonprofit that studies insurance.

Therefore many people are left with difficult choices like paying higher premiums, accepting reduced coverage, or even considering moving to a lower risk area.

“Insurance is based on risk assessment, and when that risk becomes too high, companies either raise rates significantly or leave the market altogether,” said insurance analyst David Collins.

Unless action is taken to slow climate change, the cost of insurance will keep rising, and for some it will disappear altogether.

However, there may be other ways to resolve the challenges.

“That solution is the Federal Natural Hazard Insurance Corporation: a private-public approach to providing homeowners insurance across all natural hazards and states that would address myriad failures in today’s insurance market,” said Clifford Rossi, a professor at the Robert H. Smith School of Business.

Rossi mentions how the Federal Natural Hazard Insurance Corporation would carve out natural hazards from existing homeowners’ policies, offering a separate policy based on a property’s exposure to the specific natural hazards in the certain location.

Without this immediate action, many people may soon be priced out of a home, not because of housing costs, but because of the rising cost of simply having an insured home in a world shaped by risky climate change.